Research View - Wild November!

November was another wild month from the perspective of markets as the price of Bitcoin displayed a negative trend, moving from $9,200 to close at $7,600 after bouncing from a low at $6,600 (on November 25th). Once again, altcoins lagged, and most of them displayed sizeable downward price movements. However, their respective fundamentals seemed to play a strong role with large idiosyncratic factors leading to positive price changes for a few altcoins over this month (e.g., Matic Network and Enjin).

Owing to the drop in the price of ETH (in line with the overall market movement), DeFi has seen its cumulative amount of ethers locked reaching new highs with a peak at 4.4 million ETH locked on November 29th. Meanwhile, Maker released the Multi-Collateral Dai (called DAI), which operates side-by-side with Single Collateral Dai (ex-DAI, now SAI). As of December 4th, an estimated 54% of the SAI had been converted into DAI1.

Other significant developments are bound to happen on the altcoin side, such as Cardano’s Shelley mainnet upgrade, the v3 of the 0xProtocol moving to ETH mainnet, and Elrond’s upcoming mainnet launch in December.

Furthermore, Binance Futures continued its meteoric growth, and the recent addition of a second perpetual contract on the platform (ETH/USDT, with leverage up to 50) could potentially foster supplemental trading opportunities for all crypto-derivatives traders.

Crypto spot markets

Table 1 - Overview of the largest assets by market cap (EOM - November 2019)

Ticker | Name | Monthly price change (%) | Average daily Binance volume (USDT) | Monthly avg. volume change (%) | Marketcap (EOM - USD) |

|---|---|---|---|---|---|

Bitcoin | -17.4% | 369.9 M | -2.3% | 136.83 B | |

Ethereum | -16.5% | 68.6 M | -27.7% | 16.59 B | |

XRP | -23.4% | 36.4 M | -31.5% | 9.81 B | |

Litecoin | -18.7% | 24.1 M | 0.7% | 3.03 B | |

Bitcoin Cash | -21.7% | 32.1 M | -4.1% | 3.97 B | |

BNB | -21.1% | 32.1 M | -10.3% | 2.44 B | |

EOS | -15.5% | 30.7 M | -4.0% | 2.60 B | |

Stellar | -11.4% | 12.0 M | 108.9% | 1.20 B | |

Cardano | -1.7% | 10.2 M | -2.9% | 1.05 B | |

Monero | -7.0% | 5.6 M | -9.0% | 0.95 B |

Table 2 - Monthly top 3 gainers on Binance.com in November 2019

Table 3 - Monthly top 3 losers on Binance.com in November 2019

Chart 1 - Bitcoin monthly trading dominance in 2019 on Binance.com

As a reminder, we defined Bitcoin trading dominance, such as:

“Bitcoin trading dominance represents the respective volume contribution from Bitcoin trading, with BTC as a base currency, relative to the total spot volume on a platform (e.g., Binance) over a period of time.”

Source: Binance Research

Bitcoin trading dominance remained above the 40% mark in November, a slight increase (+1.45%) from October 2019. Meanwhile, the Bitcoin market dominance remained flat at 66-67% for the entire month.

Table 4 - New asset listings in November 2019

Ticker | Name | Pair asset(s) | Listing date |

|---|---|---|---|

BTC, BNB, USDT | November 6th | ||

BTC, BNB, USDT | November 22nd |

Only two new assets were added to the platform in November: ARPA and Cortex (CTXC), following their wins at respective community coin competitions.

In November, BUSD also continued its expansion with four new base assets being added for trading against it: Tron, EOS, Stellar, and Cardano.

On-chain markets on Binance DEX

In November 2019, Binance DEX displayed minor activity with only 4 new pairs being listed, comprised of two new stablecoin listings. As of November 30th 2019, Binance DEX had 117 pairs.

Table 5 - New DEX stablecoin pairs in November 2019

The two other pairs which were listed are:

Atlas Protocol on November 5th (against BNB)

Travala.com (AVA) on November 25th (against BNB)

Chart 2 - Volume on the Binance DEX since August 2019 (USD million)

Sources: Binance Research, Binance Chain

As illustrated in chart 3, the daily volume on the Binance DEX remains quite low, around $1.3 million. BNB quote asset markets remain the largest, with more than 98% of the volume occurring there.

Binance Chain has improved its mainnet with the Heisenberg upgrade2. There have been substantial performance improvement, especially for a large number of addresses, change in the lot-size enhancement (with the lot size being now calculated based on its price against BNB), and a change in listing transaction fees (both owners of quote-asset and base-asset can now send listing transactions).

Derivatives markets

For its third month, Binance Futures continued its fast growth, and the volume on BTC/USDT perpetual contract was higher than the xtotal spot volume across all pairs on Binance.com.

Binance Futures’ perpetual BTC/USDT contract displayed a median daily volume of $920 million in November.

Chart 3 - Volume of Binance BTC/USDT perpetual futures contract (in USDT million)

Source: Binance Research, Binance.com

As discussed in the previous Global Markets report, the volume of BTC/USDT perpetual contract remained higher than the spot market, hence illustrating the “the new normal”.

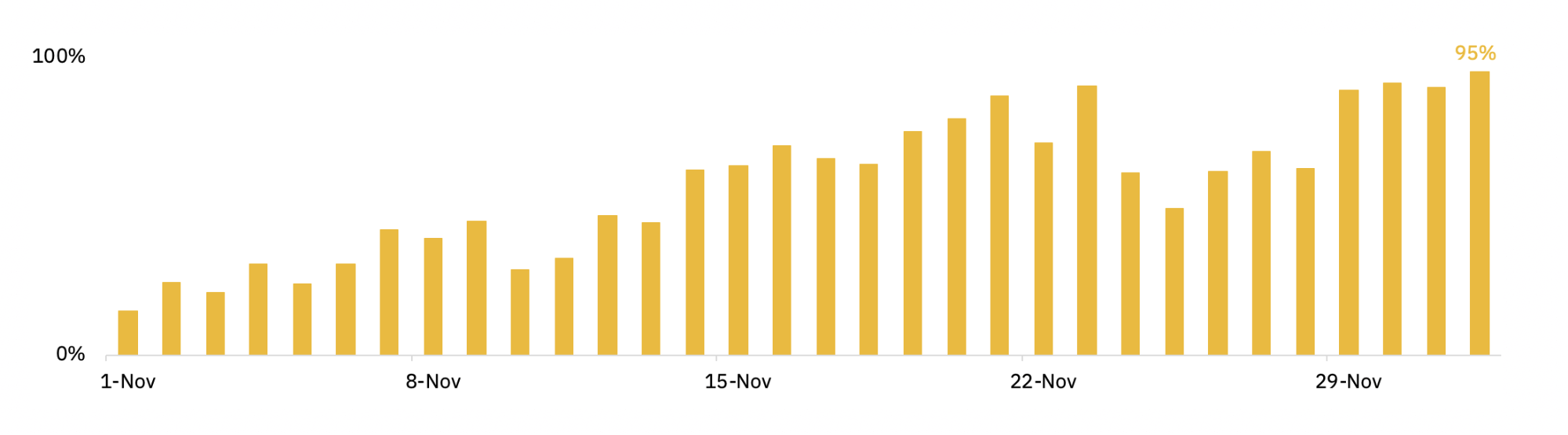

Meanwhile, the Open Interest (OI) has been steadily increasing, finishing the month with an MoM increase of +95% compared to the OI recorded on October 31st.

Chart 4 - Growth of the Open Interest on BTC/USDT perpetual contract (relative to October 31st 2019)

Source: Binance Research, Binance Derivatives (internal data)

On November 30th, Binance launched its second perpetual contract, ETH/USDT with leverage up to 50x. We will keep a close eye to see whether the story repeats itself for ETH/USDT markets. Will ETH/USDT perpetual contract’s volume be higher than the spot volume?

Borrowing and lending markets

Borrowing and lending markets remained extremely active in November, with two new assets added for margin trading: IOTA and Tezos (XTZ).

Furthermore, ETH quote pairs for XRP and BNB (as base assets) were also added, in early November.

Table 6 - New pairs eligible for margin trading in November 2019

Interestingly, we noticed greater depth on the orderbooks for margin traded assets following their addition to the margin trading system.

Quick case study - Effect on Bitcoin Cash (BCH)

Bitcoin Cash (BCH) was added for margin trading on August 22nd 2019. As a result, we analyzed whether it had impacted the structure of the orderbooks since its addition to margin trading services.

Our methodology works as follows:

First, we aggregated, by base asset quantities, the percentile-based (1%, 5%, 10%) bid and ask quantities for each of the BCH pairs (e.g., BCH/BTC, BCH/USDT) at various high-frequency snapshots of the orderbooks. Percentiles were defined as relative to the best bid/ask on both sides of the orderbook at each snapshot.

After, we looked at the lowest 5% percentile, of these different snapshots of the orderbooks on every trading day between September 2nd and November 25th, for bid and ask aggregated orderbook quantities.

Finally, we plotted these cumulative quantities at a daily frequency.

Chart 5 - Cumulative bid quantities for different percentiles (in BCH)

Chart 6 - Cumulative ask quantities for different percentiles (in BCH)

First of all, the cumulative quantity size on the buy-side increased following the addition of BCH to the margin trading platform. From September 2nd to November 25th, the 10% cumulative buy quantity increased by nearly +33%, moving from ~ 3,000 BCH to ~ 4,000 BCH.

However, the increase in the cumulative ask quantity is even more notable (chart 6), with an increase in the 10% cumulative sell quantity of +50%, from ~ 4,000 BCH to ~ 6,000 BCH. In this period, the 10% cumulative ask quantity even spiked twice above 10,000 BCH on November 5th and November 18th.

Margin trading could potentially lead to greater efficiency in how resources are allocated within the exchange, as “bearish individuals” are now able to build short positions by borrowing assets from individuals that are long on the asset (i.e., holding the underlying on their portfolios and locking assets through lending).

Thanks to the ongoing support of new assets for margin trading, price discovery will likely further improve in the coming months for many other cryptoassets. This rise in both buy and sell side depths for BCH markets illustrate the overall positive effect on the liquidity profile on assets when greater price discovery becomes possible.

Staking markets

Staking markets have become increasingly relevant from the perspective of all crypto-participants, as illustrated in our recent report.

Owing to this recent paradigm shift in the digital asset industry, Binance Staking is a new service launched in the second half of 2019, which offers passive rewards for many cryptoassets supported by Binance3.

Firstly, Stellar discontinued its inflation rewards at the end of October; hence, it has been removed from Binance Staking’s set of offerings. However, Elrond (ERD), Harmony (ONE), and Fetch.ai (FET) had their first staking distributions disbursed during November.

Interestingly, the three projects were all Binance Launchpad projects, displaying the growing maturity of projects within Binance’s ecosystem4.

Staking yields vary greatly amongst stake-able assets, with expected yields ranging from 1% (NEO) to as high as 14% (ALGO). Uniquely, Binance Staking provides zero-fee staking rewards, allowing users to get the full yields collected from staking funds on their behalf.

Chart 7 - Expected yields (%) for assets supported for soft staking on Binance.com

Source: Binance Research, Binance.com

As of December 4th 2019, staking services are currently supported for 12 assets.

Views from Binance Trading

This section has been prepared by Binance Trading, one of the world’s most liquid OTC desks for cryptocurrencies and digital assets5. The content reflects the views of Binance Trading solely.

FUD, but no big short!

From the $50m hack at a top Korean exchange to Chinese exchanges shutting down, and CEOs vanishing with cold wallet keys, November was not a pretty month for crypto. BTC also dropped from $9,200 at the beginning of the month to $7,600 at the end of the month, falling as low as $6,600 at one point, with total market cap also dropping by around $40 billion.

One exciting thing that occurred this month was what seemed to be a correlated increase in price for some past Launchpad projects. Starting at around November 25, several Launchpad tokens saw a sharp rise in price, with MATIC even doubling in price in the span of a few days.

We decided to take a look at taker buy-sell ratio data from our exchange for Matic Network (MATIC), Fetch.Ai (FET), Elrond (ERD), Band Protocol (BAND), and Harmony (ONE) to see if certain regions may have spurred the rallies but found little to no correlation.

For example, MATIC saw a higher taker buy-sell ratio in East Asia and Western Europe. In contrast, the ratio was much lower in Eastern Europe, meaning this region sold more in terms of taker orders. FET was more even across different areas, although it did see a lower ratio in Eastern Europe. BAND was also quite even but saw lower ratios in East and Southeast Asia, as well as Western Europe. ERD saw higher ratios in Eastern and Western Europe as well as Southeast Asia. ONE had higher ratios in Southern and Eastern Europe. Although possible, the rallies in Launchpad tokens do not seem like a coordinated effort.

Our OTC desk did see some more trades and quote requests for Launchpad tokens than usual, but it was not anything too out of the ordinary. Along with Launchpad tokens, there was some more demand for privacy coins than usual. As with last month, there was a high number of altcoin trades, which was not that unusual given the fluctuations in BTC. What was a bit surprising was that it was a rather quiet month for BTC comparatively in terms of flow, although flows were sell-dominant as one might expect.

To follow the migration in real-time. https://sai2dai.xyz/↩

https://community.binance.org/topic/2176/binance-chain-mainnet-heisenberg-upgrade-announcement↩

An increasing number of assets will be supported gradually. For instance, Binance now supports zero-fee staking for Tezos (XTZ). https://twitter.com/binance/status/1201849033850945541↩

If you wish to trade large volumes with an efficient settlement procedure and competitive quotes, join Binance Trading on Telegram or send an email to tradedesk1@binance.com. Please reach out to one of the official traders on the channel, confirm your account and get ready to exchange the world.↩